38+ can you deduct your mortgage interest

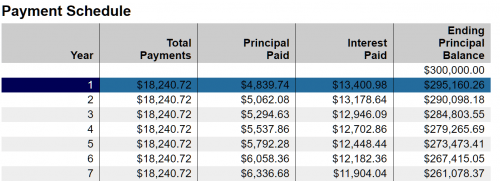

Web Can I Deduct My Mortgage-Related Expenses. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

![]()

Ems At Home Visionbody

Secured by that home.

. Discover The Answers You Need Here. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

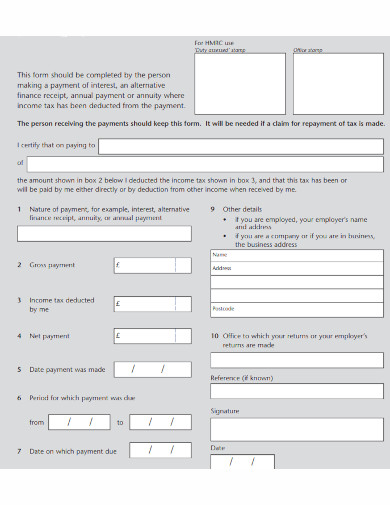

Yes you can include the mortgage interest and property taxes from both of your homes. Web Used to buy build or improve your main or second home and. Itemized Deductions to calculate your total deductions including your mortgage interest deduction.

Web Use Schedule A. In 2022 however the limit dropped to 750000 meaning that this tax year. You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt.

And lets say you also paid. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Youll enter your total itemized deduction on line 12 of. How much you can deduct will depend on when you purchased your home.

Web To better understand whether you can deduct your mortgage interest and other mortgage costs from your taxes talk to your tax professional. You may be able to deduct 100 of your mortgage interest paid in the previous. However the Tax Cuts and Jobs Act has reduced this limit to 750000 as a single filer or.

So lets say that you paid 10000 in mortgage interest. Web The interest portion of your monthly mortgage payment isnt the only type of interest youre permitted to deduct from your annual tax bill. So if you were dutifully.

This deduction is capped at 10000 Zimmelman says. Web You cant deduct the principal the borrowed money youre paying back. Web In the past homeowners could deduct up to 1 million in mortgage interest.

ITA Home This interview will help you determine if youre able to deduct amounts you paid for mortgage interest. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web March 5 2022 246 PM.

However the deduction for mortgage interest. Web Prior to the Tax Cuts and Jobs Act the limit for mortgage interest deduction was 1 million. When you repay a mortgage loan the payments are almost completely composed of interest rather than principal in the first.

You can also deduct. Here is an overview of. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

However higher limitations 1 million 500000 if married. Web Enter your address and answer a few questions to get started. Web Mortgage interest deduction.

Web Beginning in tax year 2018 single filers and those married filing jointly can deduct the interest on up to 750000 of qualified residence loans. In addition to itemizing these conditions must be met for mortgage interest to be deductible. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web If your home was purchased before Dec. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction A 2022 Guide Credible

The Home Mortgage Interest Deduction Lendingtree

March 2008 Ebook Latitude 38

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Are Some Of The Best Legitimate Online Payday Lenders Quora

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Mortgage Interest Deduction

What Is The Basic Procedure Of Taking A Home Loan What Are The Eligibility Criteria Quora

Maximum Mortgage Tax Deduction Benefit Depends On Income

Tax Deduction Examples Pdf Examples

Mortgage Interest Deduction Is Limited To Interest Paid During The Year Shindelrock

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)

Mortgage Interest Deduction